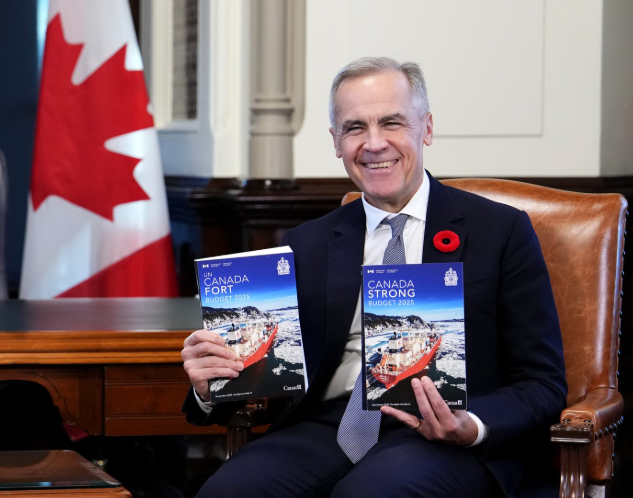

OTTAWA, Nov. 10, 2025: Finance Minister François-Philippe Champagne unveiled Budget 2025: Canada Strong, marking the first federal budget under Prime Minister Mark Carney. The budget introduces a range of proposals aimed at improving affordability, enhancing tax efficiency and boosting economic competitiveness.

While these proposals are not yet law and still require parliamentary approval, they could impact individuals and businesses if passed. From potential changes to personal taxes to new incentives for innovation and investment.

The highlights below break down what could matter to you. We also share our perspective on the Canadian economy, the markets and the budget’s deficit. Read more to understand how the proposals may impact your financial plan.

Proposals for individuals:

Tax changes and proposals:

Middle class tax cut:

On July 1, 2025, the government lowered the first marginal personal income tax rate from 15% to 14%, saving a two-income household up to $840 per year.

Consumer Carbon Price:

On April 1, 2025, the consumer carbon price was removed, reducing gasoline prices in most provinces by up to $0.18/L compared to 2024-25.

Home Accessibility Tax Credit:

Effective 2026, expenses claimed under the Medical Expense Tax Credit cannot also be claimed under the Home Accessibility Tax Credit.

Canada Disability Benefit:

Beginning in 2026-27, Canadians with disabilities will receive a $150 Canada Disability Benefit (CDB) payment for each certification or re-certification of the Canada Disability Tax Credit (DTC) to offset the application cost. This change will be retroactive to the launch of the CDB. The government also promises a future review of the Income Tax Act and how the CDB is treated as income. Approval for the DTC is required to open a Registered Disability Savings Plan (RDSP), which helps qualifying Canadians with disabilities save for their future.

Underused Housing Tax (UHT):

The 1% annual tax on vacant or underused residential properties in Canada will be eliminated beginning with the 2025 calendar year.

21-year rule:

The 21-year trust rule prevents trusts from indefinitely deferring capital gains. Certain tax avoidance planning techniques have been employed to transfer trust property indirectly to a new trust to avoid both the 21-year rule and the anti-avoidance rule. Budget 2025 proposes to broaden the current anti-avoidance rule to include indirect transfers of trust property to other trusts, effective November 4, 2025.

Tax credit for personal support workers:

Budget 2025 proposes to introduce a temporary Personal Support Workers Tax Credit, which would provide eligible personal support workers with a refundable tax credit of 5% of eligible earnings, providing a credit value of up to $1,100. Amounts earned in British Columbia, Newfoundland and Labrador and the Northwest Territories would not be eligible, as these jurisdictions have signed other agreements with the federal government.

Affordability & benefits:

Housing affordability:

The Government of Canada intends to restore housing affordability to 2019 levels by increasing the number of homes built annually by reducing barriers and red tape to increase productivity for builders and developers.

Launching Build Canada Homes, a program designed to increase affordable housing through public and private sector initiatives.

Eliminating the GST for first-time home buyers on new homes up to $1 million and reducing the GST for first-time buyers on homes between $1 million and $1.5 million.

Expanding the Union Training and Innovation Program, to support union-based apprenticeships to boost building capacity and productivity, while creating high-paying careers for more Canadians.

Increasing the Canada Mortgage Bond annual issuance limit by $20 billion for multi-unit housing to increase access to cost-effective mortgage funding for lenders.

Providing $2.8 billion for urban, rural and Northern Indigenous housing.

Financial fees & protection:

The government will review fees charged by banks and financial institutions including e-transfer fees, ATM fees, transfer fees on investment accounts and foreign exchange costs.

They will also develop a National Anti-Fraud Strategy that will develop a cross-sectoral approach to protect Canadians from highly complex fraud schemes.

Automatic tax filing and federal benefits for low-income individuals:

In 2026, the Canadian Revenue Agency (CRA) will begin to automatically file an income tax return for low-income individuals to ensure they receive the government benefits to which they are entitled.

Protecting Canadian culture:

Additional funding will be available for artists, creators and communities to help stabilize jobs for Canadians working in these sectors.

The Canadian Strong Pass, which offers free or discounted access to Canadian attractions, will be extended to promote Canadian tourism and improve affordability for Canadians that wish to travel within the country.

Youth summer job creation:

With youth unemployment on the rise, the government proposes investments to support job creation for 175,000 youth in 2026-27.

National School Food Program:

Launched in 2024-25 with an investment of $1 billion over five years, the National School Food Program aims to provide healthy meals to 400,000 more kids every year. The program saves participating families with two children an average of $800 per year on groceries.

Proposals for business:

Tax proposals:

Immediate expensing for manufacturing and processing buildings

Business owners can deduct the full cost of eligible buildings (and qualifying additions or alterations) in the first tax year the property is used for manufacturing or processing if the building is used primarily (at least 90% of the floor space) for manufacturing or processing activities. The deduction applies to both new buildings and eligible improvements to existing buildings, resulting in lower tax for business owners.

Lifetime Capital Gains Exemption:

As outlined in Budget 2024, the government proposes to increase the Lifetime Capital Gains Exemption up to $1.25 million in eligible capital gains.

Tax deferral through tiered corporate structures

The government proposes new rules to prevent corporations from using mismatched year ends in tiered structures to defer tax on investment income. This ensures that tax liabilities are recognized on time, closing loopholes that allowed indefinite deferral through inter-corporate dividend timing strategies.

Luxury tax on aircraft and vessels:

Luxury tax on aircraft and vessels will be eliminated effective November 4, 2025, providing relief to the aviation and boating industries.

Benefits & incentives:

Qualified investments for registered plans:

Budget 2025 proposes to simplify and streamline the rules related to registered plans holding investments in small businesses. Effective January 1, 2027:

RDSPs can acquire shares of specified small business corporations, venture capital corporations and specified cooperative corporations.

Shares of eligible corporations and interests in small business investment limited partnerships and small business investment trusts would no longer be qualified investments.

Scientific Research and Experimental Development Tax Incentive Program:

To support Canadian businesses’ ability to conduct innovative research, the government confirms its intention to increase the Scientific Research and Experimental Development (SR&ED) expenditure limit from $4.5 million to $6 million.

Canadian Entrepreneurs’ Incentive (CEI):

Due to the cancellation of the proposed increase to the capital gains inclusion rate, the Canadian Entrepreneurs’ Incentive (CEI) announced in Budget 2024 has also been cancelled.

What the budget means for the Canadian economy, investors and the deficit:

Budget 2025 proposes higher borrowing in coming years to finance the proposals. The objective is to improve short- and long-term growth for Canada while providing support to several industries across the country. Here are three takeaways from this year’s budget.

The economy:

As GDP has been growing by less than 2% in recent years, and is projected to grow by just over 1% this year amid acute trade tensions with the U.S., the budget will provide some modest short-term stimulus.

Longer term, the budget investments proposed for the next five years are targeted at boosting productivity growth, which has lagged developed market peers.

The focus on housing, infrastructure and business investment is designed to improve both productivity and competition.

Impact to investors:

Budget 2025 does not significantly change our outlook for the Canadian financial markets. However, the immediate expensing for manufacturing and processing buildings for business, along with the proposed removal of the oil and gas emissions cap and increased infrastructure spending could provide a modest boost to sectors such as industrials, energy and materials. As part of our opportunistic Canadian equity sector guidance, we recommend investors consider overweighting these three sectors.

From a broader perspective, we believe the global outlook for equity markets is supportive, aided by easing global monetary policy and increased fiscal support across several developed economies. We recommend investors consider overweighting equities relative to bonds as part of a well-diversified portfolio.

Deficit and debt:

The 2025 budget officially drops the previous government’s fiscal rule that public debt as a share of GDP should fall every year. Instead, debt levels are set to rise in coming years as the government borrows more from financial markets to finance higher spending. Despite this shift, we do not think investors should be concerned over the sustainability of public debt in Canada as both the deficit and debt levels appear manageable. Further, the government has promised to only borrow for spending that boosts investment, and hopefully long-term growth, and has promised to reduce the budget deficit annually going forward.